Protecting your home from a storm

With the increase in stormy weather in the UK, we're here to help you protect your home and offer support if your home is affected.

Storm damage prevention checklist

- Check exterior drains - Is rainwater flowing away?

- Check guttering for damage or debris - So water can flow away easily

- Check for cracks in brick work or render - It could allow water ingress

- Check for any leaks - In and around windows and doors

- Check the loft - For any hidden leaks

- Check outside drainage - Ensure areas don't breach damp course heights, e.g patios, decking driveway

- Check garden furniture - Make sure items are tied down and secure so they can't cause damage, e.g trampolines

- Tree safety - Check trees near your property are healthy and not likely to fall or cause damage

- Inspect flat roofs for damage or leaks - Flat roofs in particular have a shorter lifespan

- Check tiles on roof - For loose or cracked tiles or slates

- Check mortar on chimney - Ensure it is in good condition and not degraded

Prevent, protect and repair

Find out what you can do before, during and after a storm - to help protect you and your home.

Have you been affected?

Next steps

If your home has been damaged by storm conditions, we understand how distressing it can be and we're here to help as best we can.

- Check your home insurance cover view policy documents

- Gather what you need to make a claim online

- Make a claim online it's quick and easy

- Need to check an existing claim? You can manage it online

- If you'd prefer to speak to someone, you can get in touch via our virtual assistant

Storm cover - what is and isn't covered?

By a storm, we mean strong winds of over 55mph or damage by extreme rain, snow or hail. Not sure what storm cover includes?

Here's an overview.

Frequently asked questions about storm events

How do I make a claim?

We've outlined the steps that you should take if you need to check for storm damage or make a claim.

How to make a storms claim

How do I check my cover?

If you need to know exactly what your home insurance covers, the quickest way is to check your policy documents. Here is a quick overview.

Do you need urgent support?

- Is your property uninhabitable or unsecured?

- Do you need to make us aware of any exceptional circumstances affecting you or someone you live with?

- If so, then please get in touch by calling 0345 165 5753 and we'll get you to the right person as soon as possible.

What is covered by storm damage?

- This will depend on the cover you have. If you have buildings cover, in the event of a successful claim, any part of your building which has been damaged as a result of the extreme weather will be covered.

- If you have contents cover, then any damaged contents will be covered.

- Policy limits are shown in your policy documentation.

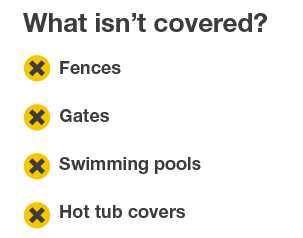

- Fences, gates, trees and hedges are not covered in the event of storm damage under your buildings cover. Please refer to your policy booklet as some garden items may be covered under contents cover if you have that.

When would my storm claim not be covered?

In many declined claims it is not the weather event which caused the damage but an existing underlying problem, which the recent weather event highlighted.

Wear and tear is a common reason as to why storm claims are declined. This is especially the case with flat roofs that are over 10 years old or old tiled roofs.

It's difficult for a weather event to damage well-maintained properties, unless it is quite extreme. For more information, please refer to the section 'What counts as storm damage?'

What if my property is not safe to live in?

We understand that some customers like to stay in their own homes where possible, so we can provide facilities like temporary kitchens and bathrooms to enable you to do so. If you do have to leave the property, we will help you make those arrangements, whether this is staying with relatives or checking into suitable alternative accommodation.

For more information on alternative accommodation cover please refer to your policy documentation.