Protecting your home from a freeze

With the increase in extreme weather in the UK, find out how you can protect your home and keep the cold out.

Prevention checklist

Here are the key measures you can take to prevent damage to your home from the cold.

-

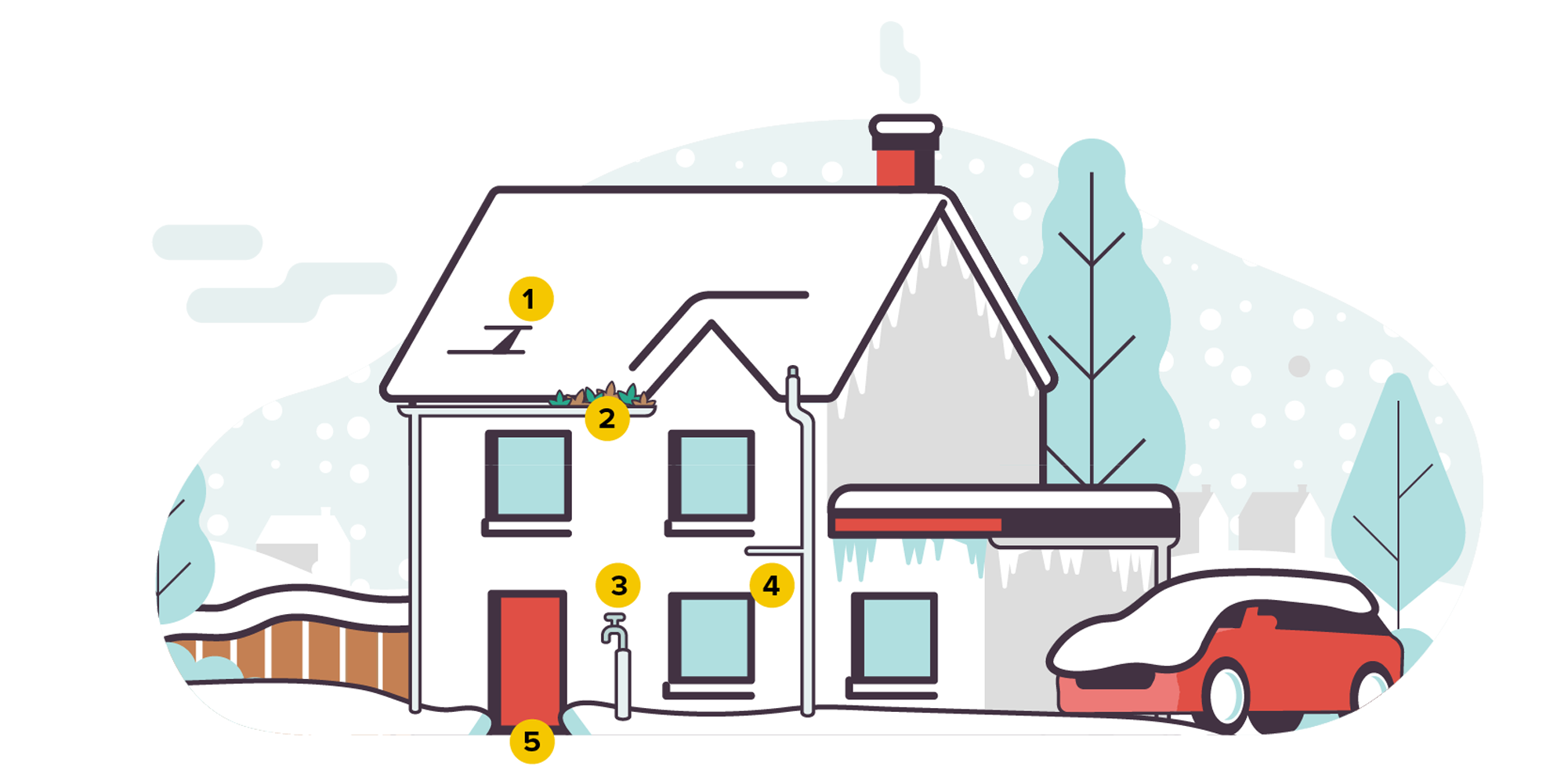

Tiles

Check your roof for missing tiles, not forgetting felt on sheds and garages – if necessary.* -

Gutters

Keep your gutters, gullies and drains, including downpipes, clear of leaves.* -

Taps

Insulate external taps with lagging to prevent them freezing. -

External pipes

Insulate external pipes with lagging to prevent them freezing. -

Paths

Clear them of ice, using sand, grit or salt.

*You may want to call in a professional rather than attempt to inspect high roofs or gutters yourself.

-

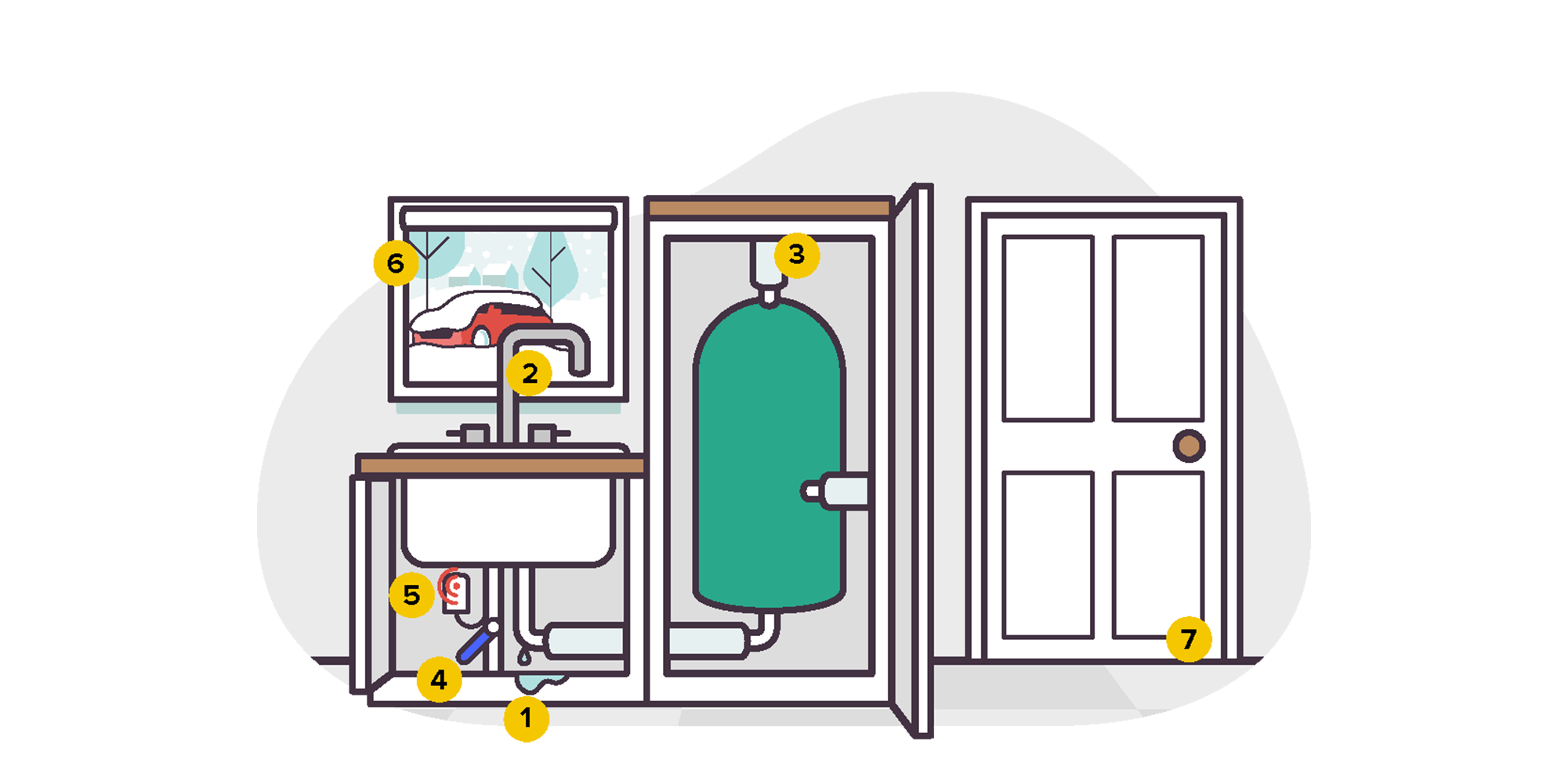

Check pipes for leaks or drips.

Look for split, dripping, rusting or oxidised pipes and joints, and run the taps to make sure that water is free flowing.

-

Repair dripping taps

It’s important to get leaky taps, showers and toilets fixed by a plumber, as even small trickles of water can lead to frozen pipes.

-

Insulate pipes and tanks

Use lagging on your pipes and tanks in loft spaces and other draughty areas, such as garages and outbuildings, to prevent them from freezing.

-

Test your stop tap

Make sure you know where your internal stop tap (also known as an isolation valve or stopcock) is located. It’s the quickest way to stop a water leak. Test it by turning it on and off several times, as stop taps can seize up.

-

Consider fitting a leak detector

Leak detectors monitor your usual water use and can turn off the water if they detect a leak. Alternatively, you can use your water meter to check for leaks.

-

Insulate windows

Buy weather strips or insulation foam from stores and apply it to your windows. It’ll stop cold from getting in and doesn’t cost too much.

-

Doors

Use draught excluders around doors to help keep your home warm and reduce energy bills.

Freeze: Tips to prevent damage

Find out what you can do to prevent damage to your home and keep warm when the temperatures drop.

Do you need to make a claim?

If your home has been affected by extreme weather, we understand how distressing it can be and we're here to help as best we can.

Next steps

- Check your home insurance cover and excess view policy documents.

- Gather what you need to make a claim online

- Make a claim online, it's quick and easy

- Need to check an existing claim? You can manage it online

- If you'd prefer to speak to someone, or for more information to make a claim you can get in touch via our virtual assistant

Extreme weather: what is and isn't covered?

Extreme conditions include extreme snow or hail, not sure what your cover includes? Here's an overview.

Read more

Please note this relates to our standard Rias Home Insurance policy.

What to do after a freeze

Find out what to do if you need to make a claim, and how to reduce the damage to your home once the freeze starts to thaw.

Frequently asked questions

How do I make a claim?

We've outlined the steps that you should take if you need to check for water or storm damage and you need to make a claim.

How to make a claim

How do I check my cover?

If you need to know exactly what your home insurance covers, the quickest way is to check your policy documents. Here is a quick overview.

Do you need urgent support?

- Is your property uninhabitable or unsecured?

- Do you need to make us aware of any exceptional circumstances affecting you or someone you live with?

- If so, then please get in touch by calling 0345 165 5753 and we'll get you to the right person as soon as possible.

What are buildings?

In insurance, Buildings are defined as the property shown in your insurance schedule/statement of fact. They include the structure of your home, including any fixtures and fittings, garden walls, gates, decking, paths, drives, patios, permanent swimming pools built of brick, stone or concrete, permanently fixed hot tubs, solar panels, fully enclosed outbuildings and hard tennis courts.

- Unless otherwise agreed, outbuildings do not include:

- Any building which is not on a permanent foundation or base

- Tree houses

- Inflatable buildings (whether over swimming pools or not)

- Any structure which is made of canvas, PVC or any other non-rigid material

PLEASE NOTE: Carpets are considered contents.

What is covered by buildings insurance?

This will depend on the cover you took out when you purchased your buildings policy.

Essentially, your standard buildings insurance policy will cover the cost of repairs to your home if it is damaged by an insured event such as theft, fire, flood and escape/leakage of water from pipes, storage tanks, etc. If you also purchased the optional add-on cover of Accidental Damage, that will cover you for other instances relating to accidental damage (which is damage that is unexpected and unintended, caused by something sudden and which is not deliberate).

There will be exclusions for each type of peril, so please refer to your home insurance policy booklet for full details of your cover.

What are contents?

Contents insurance will cover the items and valuables within your home that are not permanent features, fixtures or fittings of the building.

This will usually include things like your furniture, kitchen appliances, jewellery and entertainment systems.

Some items, such as carpets, may seem like buildings but are, in fact, considered contents.

If you are unsure what your item falls under and need to make a claim, get in touch with the Claims Team and they will be able to work this out for you.

What is covered by contents insurance?

This will depend on the cover you took out when you purchased your contents policy.

Essentially, your standard contents insurance policy will cover the cost of repairing or replacing the contents of your home if they are damaged by an insured event such as theft, fire, flood and leakage of water. If you also purchased the optional add-on cover of Accidental Damage, that will cover you for other instances relating to accidental damage (which is damage that is unexpected and unintended, caused by something sudden and which is not deliberate).

There will be exclusions for each type of peril, so please refer to your home insurance policy booklet for full details of your cover.