Shape your cover

Get the reassurance you need when you’re on the road with our breakdown cover, powered by the RAC. The last thing you need is to be stranded, so we’ve got your back if you ever get stuck. Just take your pick from three levels of cover to suit your budget.

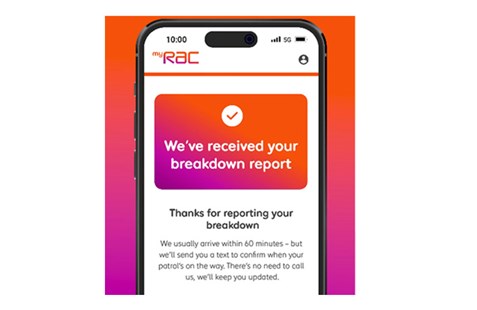

Each level of cover includes access to the myRAC app, to make things easier if you do break down. With the app you can report your breakdown and keep updated in real time until your RAC patrol arrives. Using the myRAC app is the quickest way to get help.

Whichever policy you go for, you’ll have peace of mind that our network of RAC patrols are there for you 24/7.

What's included?

Level one

-

Roadside assistance

Gives you RAC's roadside assistance and local vehicle recovery, 24 hours a day, 365 days a year.

Level two

-

Comprehensive gold

In addition to Roadside Assistance, this covers: Local and long-distance journeys – this level of cover provides full UK assistance, onward travel and assistance at home for great all-round protection.

Level three

-

Total protection

In addition to Comprehensive Gold this covers: European motoring trips, each trip is limited to a total of 90 days.

What's not covered

- The cost of any replacement parts

- Assistance for vehicles not in a roadworthy condition

- Any breakdown resulting from a fault that the RAC have previously attended and:

-

- the original fault has not been properly repaired;

- or the RAC's advice after a temporary repair has not been followed.

Find out more about this service in our policy documents.

Optional extras for added peace of mind

We're rated highly on Trustpilot

myRAC app

We understand that breaking down can be worrying. But with Rias and the RAC, we’ll put your mind at ease.

Benefits of downloading the myRAC app:

- Peace of mind knowing you can reach the RAC's breakdown specialists via the app, 24/7

- Report a breakdown in seconds

- Pinpoint your location with precision so your RAC patrol knows exactly where to find you

- Keeps you updated in real time until your RAC patrol arrives

- Keep important vehicle information and breakdown policy details securely within the app

Frequently asked questions

What is car breakdown cover?

Breakdown cover is insurance that provides you with roadside assistance and vehicle recovery if your car breaks down. It can usually be added to your car insurance policy as optional cover for an additional cost, although some insurers also offer it as a separate insurance policy.

What does breakdown cover include?

Breakdown cover varies depending on your insurer and the specific product you purchase, as most providers offer different levels of cover at different costs. As a minimum, breakdown insurance will include 24/7 roadside assistance and local vehicle recovery. Breakdown cover may also include:

- Onward transport

- National vehicle recovery

- Home assistance

- Roadside assistance in Europe

- The policy covers Roadside Assistance

- Unlimited call outs per year

- Unlimited tows per year

- £0 excess payable per claim

- Cover for cars of any age

- Provided by RAC

- Cover if the car runs out of fuel

- Misfuelling cover

- Assistance 1/4 of a mile from home

What types of breakdown cover are there?

The most common types of breakdown cover are vehicle cover and personal cover.

Vehicle cover means your car is covered in the event of a breakdown, regardless of who’s driving it – provided they are insured to do so. Some providers offer the option to cover several vehicles on the same policy.

Personal cover means that you can be covered individually as a driver or a passenger, regardless of the vehicle. Some insurers will allow you to cover several members of a household under the same breakdown cover policy.

Within each type of cover, you are also likely to be offered different levels of breakdown insurance, with wider benefits being offered for the ones with the higher cost.

Can I get immediate breakdown cover?

If your car breaks down unexpectedly and you have breakdown cover in place, your provider should be able to send assistance straight away.

If you don’t have breakdown cover, there are a few providers who offer instant cover or emergency roadside assistance even if you aren’t a customer. It’s worth bearing in mind that the costs and levels of cover offered on instant breakdown cover will depend from one provider to another, whereas having a breakdown cover policy in place means you will already be aware of the cover you have and will have already paid for it.

What happens if you don't have breakdown cover?

If you don’t have breakdown cover and your car breaks down you have a few options. You can either contact a garage to recover your vehicle for a cost or the highways agency if your vehicle breaks down on the motorway. Alternatively, you can get instant breakdown cover by contacting a provider who offers immediate cover. It’s worth noting that these options are likely to be much more costly than setting up breakdown cover in advance.

Do I need breakdown cover?

Breakdown cover is not mandatory, so it’s up to you to decide if you want to set it up, either as an add-on to your car insurance policy or as a separate policy. However, having breakdown cover in place can give you a lot of peace of mind, as it will ensure you can receive the assistance you need quickly if your car breaks down without having to pay for it on the spot.

Who provides the Rias Motor/Van Breakdown product?

Breakdown cover is arranged and administered by Ageas Retail Limited and provided by RAC Motoring Services & RAC Insurance Limited.